- PROGRESS BILLING IN QUICKBOOKS DESKTOP HOW TO

- PROGRESS BILLING IN QUICKBOOKS DESKTOP PASSWORD

- PROGRESS BILLING IN QUICKBOOKS DESKTOP PROFESSIONAL

To do this, go to Edit → Preferences → Accounting → Company Preferences in QuickBooks and click the Set Date/Password button. Vendor Bill: change the date on the bill being sent to QuickBooks to be after the closing date in QuickBooks.Ģ.Remove or reset the closing date in QuickBooks: Change the Date field to be after the closing date in QuickBooks. Invoice: recall the invoice on the Sales Invoicing screen in ESC. Use either method then try to post the invoice again.ġ.Change the date of the transaction you are attempting to modify or post: There are two ways to resolve this issue.

PROGRESS BILLING IN QUICKBOOKS DESKTOP PASSWORD

If you are sure you really want to do this, please ask a user with Admin privileges to remove the password for editing transactions on or before to closing date (this setting is in the Account Company Preferences), then try again.Ī closing date has been set in QuickBooks that is on or after the date of the bill or invoice you are attempting to edit or modify. Here's a link to reach them: Contact QuickBooks Desktop support.The following error may appear when clicking the Save and Bill button on a Purchase Order or the Receive Items screen or when posting invoices to QuickBooks:Īn attempt was made to modify a Bill/Invoice with a date that is on or before the closing date of the company. You can also contact our Customer Care Team within support hours if you need more help in locating your backup file. Once you've found the recent backup file, you can restore it and review the recorded transactions: Restore a backup of your company file. You can follow the steps in this article to locate the most recent backup file: Company file is missing or cannot be found. We have two ways to get the payments back.

PROGRESS BILLING IN QUICKBOOKS DESKTOP PROFESSIONAL

Simply add details to the invoice template to create a unique and professional invoice for your customers in the format of your choice. If there is no history that the payment was created or the company file is damaged, there's a possibility that you have opened a backup file that doesn't include the recorded payments. Our blank invoice templates are designed for small business owners looking for a quick way to bill clients and customers for goods and services they provide. Also, the Verify and Rebuild process will verify the condition of your company file. The Audit Trail report should be able to tell us whether the payment was deleted or not. Tag me in your reply and I’ll get back to you as soon as I can. I’ll be around if you have other follow-up questions about your progress invoice.

PROGRESS BILLING IN QUICKBOOKS DESKTOP HOW TO

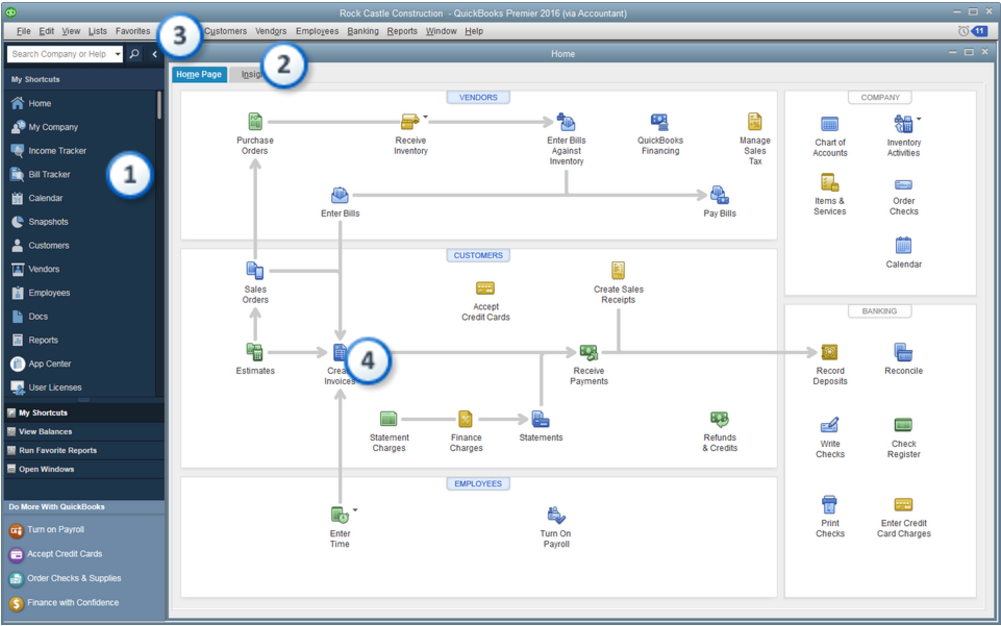

This can walk you through the steps on how to access your reports outside QBDT You can also utilize this report as future guidance: Export reports as Excel workbooks in QuickBooks Desktop. This will show you how much you invoice for each estimate.

To track your progress invoices efficiently, I suggest running the Job Progress Invoice vs. This identifies and resolves most data issues in your company y file. However, if there are no changes made, I recommend running the Verify and Rebuild utility tool. The procedure described here for handling work in progress (WIP) or construction in progress (CIP) in QuickBooks assumes that all revenue and costs will be tracked as assets (for costs) and liabilities (for revenues) until the. If they were edited, click on it and enter the correct information. Many engineering firms, attorneys and other similar organizations like to use work in progress (WIP) accounts as well. If the transactions were deleted, click on it and Create a copy.

0 kommentar(er)

0 kommentar(er)